The amount of costs is an important factor for future pensions. Of the factors affecting pension capital, the size of costs is the one which the responsible authorities have the greatest opportunity to influence. In the case of premium pension, however, costs also depend on the saver’s own choice of fund.

This section brings together gross1 and net reported costs2 and also transaction costs which are impossible for the National Pension Funds and the Swedish Pensions Agency to wholly quantify. The aim is to provide as complete a picture as possible of the total costs of the old-age pension system. It is important to keep in mind that net management costs and transaction costs have already had a negative effect on the performance of the funds.

The total cost of insurance administration and capital management for the pension system, in addition to other charges, amounted to SEK 7.4 billion, of which SEK 2.5 billion is reported in the income statement of the pension system. The SEK 2.5 billion is the sum of insurance administration (SEK 1,441 million) and the operating expenses of the National Pension Funds (SEK 1,018 million). See table 5.1.

For inkomstpension the costs reported in the income statement amounted in 2020 to SEK 1,918 million, of which SEK 900 million was for insurance administration and SEK 1,018 million was for National Pension Funds’ operating expenses. In addition to the SEK 1,018 million in operating expenses, the National Pension Funds had fixed management fees of SEK 617 million. The sum of reported asset management costs as shown in the National Pension Funds’ income statements thus amounted to SEK 1,635 million. Performance-based fees and transaction costs such as brokerage commissions are not reported as direct costs by the National Pension Funds but instead have a negative effect on returns. Performance-based fees are not ordinary management fees, but a way for the National Pension Funds to share risk and reward with their external managers. In total the National Pension Funds paid SEK 625 million in performance-based fees and SEK 269 million in brokerage commissions and other transaction costs. When these costs and fees are included, the sum total of costs for inkomstpension is SEK 3,429 million.

In the income statement of the Swedish Pensions Agency for the premium pension system are reported administrative costs of SEK 541 million. In previous years, in addition to administration costs, payments have also been made towards the cost of setting up the defined contribution pension system, a set-up loan which was repaid in 2018. The total cost of premium pension insurance administration amounted to SEK 578 million. See Total Insurance Administration in table 5.1.

Within the premium pension system the item Management Fees refers to both fixed and performance-based fees that the premium pension funds, including the 7th National Pension Fund, charge after rebates have been returned to premium pension savers. The gross calculated premium pension funds’ management fee amounts to SEK 7,362 million. Of this gross fee it is estimated that repayment from the funds provides SEK 4,854 million in the form of rebate. The net fee can then be totaled as SEK 2,508 million3. The rebate system limits the maximum fee charged. For equity funds the fee is limited to maximum 0.89 percent after returned rebate, for bond funds it is limited to 0.42 percent, and for mixed and generation funds it is limited to 0.62 percent. In addition to the SEK 2,508 million in fixed management fees an estimate of premium pension funds’ transaction costs is also shown. Transaction costs consist primarily of commissions paid by the funds when trading in securities. As of 2020, this figure is based on actual figures provided by fund companies and estimated to be SEK 955 million in 2020. In total, some 320 funds reported their transaction costs, representing about 92 percent of total capital.

| Inkomstpension | Premium pension | Total | |||

|---|---|---|---|---|---|

| Insurance administration | Pension administrationa | 459 | 472 | 931 | |

| Payments to other agencies | 441 | 69 | 510 | ||

|

Amortization and interest implementation loan |

0 | ||||

| Total Insurance administration | 900 | 541 | 1,441 | ||

| Capital management costs and charges |

Operating expenses of the National Pension Funds (reported gross) |

1,018 | 1,018 | ||

| Management fees | Fixed management fees (reported net) | 617 | 617 | ||

| Performance-based feesb | 625 | 625 | |||

| Total Management fees | 1,242 | 2,508 | 3,750 | ||

| Transaction costsc | 269 | 955 | 1,224 | ||

|

Total Capital management costs and charges |

2,529 | 3,463 | 5,992 | ||

| Total | 3,429 | 4,004 | 7,433 | ||

- The amount for the inkomstpension refers to actual cost, whereas the amount in Note 4 in chapter 8 refers to the compensation paid by the National Pension Funds for costs of administration.

- This item represents fees that the National Pension Funds pay only if a particular manager achieves a certain agreed result.

- Transaction costs refer to brokerage and clearing fees charged on the stock and derivatives market. These charges are included in the transaction and have a negative effect on the return earned by the funds. Interest and foreign-currency transactions are paid for through the spread between buying and selling prices and thus cannot be reported as a separate charge. The calculation of premium pension transaction costs is now based on the reported costs of approximately 320 funds.

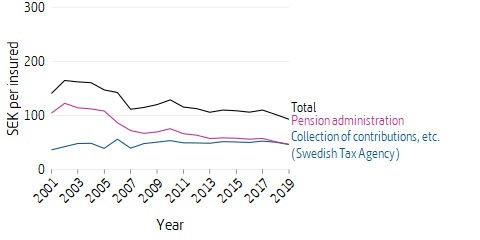

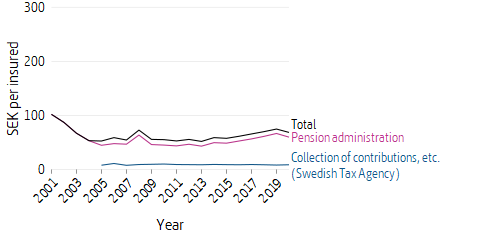

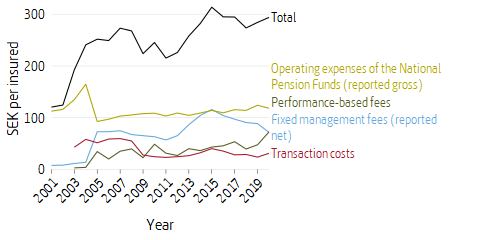

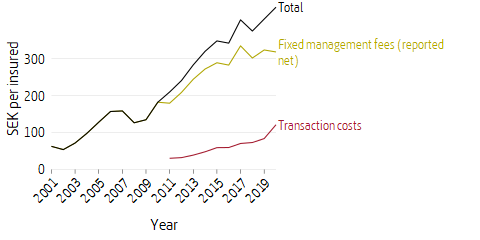

Below, in table 5.2 and table 5.3, cost items are shown for the past five years and are reported in millions of SEK. Figures refer to SEK per number of insured (i.e., more than 8.6 million people with a pension account, including pensioners) and extends from 2001.

| 2016 | 2017 | 2018 | 2019 | 2020 | |||

|---|---|---|---|---|---|---|---|

| Insurance administration | Pension administrationa | 455 | 434 | 428 | 411 | 459 | |

| Payments to other agencies | 406 | 432 | 421 | 406 | 441 | ||

| Total Insurance administration | 861 | 866 | 849 | 817 | 900 | ||

| Capital management costs and charges |

Operating expenses of the National Pension Funds (reported gross) |

890 | 953 | 956 | 1,016 | 1,018 | |

| Management fees | Fixed management fees (reported net) | 847 | 801 | 760 | 753 | 617 | |

| Performance-based feesb | 372 | 442 | 331 | 406 | 625 | ||

| Total Management fees | 1,219 | 1,243 | 1,091 | 1,159 | 1,242 | ||

| Transaction costsc | 289 | 233 | 244 | 203 | 269 | ||

|

Total Capital management costs and charges |

2,398 | 2,429 | 2,291 | 2,378 | 2,529 | ||

| Total | 3,259 | 3,295 | 3,140 | 3,195 | 3,429 | ||

- The amount for the inkomstpension refers to actual cost, whereas the amount in note 4 in chapter 8 refers to the compensation paid by the National Pension Funds for costs of administration.

- Some adjustments have been made to fees in 2018.

- See the explanation in table 5.1 Total Costs and Charges of the Old-Age Pension System.

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

|---|---|---|---|---|---|---|

| Insurance administration | Pension administration | 379 | 417 | 463 | 515 | 472 |

| Payments to other agencies | 63 | 68 | 66 | 63 | 69 | |

|

Amortization and interest implementation loan |

169 | 181 | 325 | 0 | 0 | |

| Total Insurance administration | 611 | 666 | 854 | 578 | 541 | |

| Capital management costs and charges | Management fees (net reported) | 2,033 | 2,466 | 2,279 | 2,500 | 2,508 |

| Transaction costs | 428 | 519 | 551 | 646 | 955 | |

|

Total Capital management costs and charges |

2,461 | 2,985 | 2,830 | 3,146 | 3,463 | |

| Total | 3,072 | 3,651 | 3,684 | 3,724 | 4,004 | |

Table 5.2 shows that inkomstpension costs have been somewhat stable in the last five years. After declining during several years, insurance administration costs increased in 2020. Table 5.5 shows a certain reduction in asset management costs relative to assets managed.

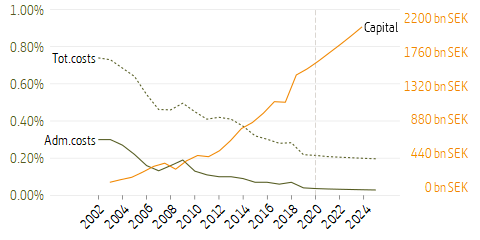

Total premium pension capital management costs and fees have increased from 2019 to 2020, also in terms of cost per insured. The development of capital management costs and fees results from the fact that average managed capital has increased and that capital management costs are charged as a percentage of capital managed. A large part of the increase can also be explained by the new method of accounting for transaction costs. On the other hand, as a percentage of the capital, premium pension costs have decreased over the last five years. The rebate system used in the premium pension system is progressive, meaning that greater managed capital requires a higher percentage discount and thus lower fees. The annual cost is estimated on the basis of costs during quarters 1–3.

There are a number of cost items within insurance administration that are common to inkomstpension and premium pension. Examples are the production and distribution of the Orange Envelope, and reimbursement to the Swedish Tax Agency for tax collection, etc. Such costs are spread between the various branches of insurance in proportion to the number of insurees, volume of fees or other factors.

In 2020 the total capital management costs for the First–Fourth National Pension Funds and for the much smaller Sixth National Pension Fund was 0.10 percent of the capital managed. The AP Funds’ performance-based fees amounted to almost 0.04 percent, and transaction costs amounted to slightly less than 0.02 percent of capital managed. The sum of asset management costs and fees totalled 0.15 percent of assets under management.

The capital management costs reported for funds within the premium pension system amounted after rebates to 0.17 percent, while the funds’ transaction costs are estimated at 0.06 percent. The total of capital management costs and charges was thus 0.23 percent of the capital managed.

The percentual cost differences between the inkomstpension’s funded assets and premium pension funds are explained partly by economies of scale within AP funds 1–4, partly because these funds invest approximately 35 percent of their capital in bonds or similar assets with low management costs compared to shares. In the premium pension system, approximately 10 percent of total assets are invested in holdings of this type.

| 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|

| Inkomstpension | 1,008 | 1,121 | 1,207 | 1,276 |

| Premium pension | 527 | 662 | 829 | 854 |

| 2017 | 2018 | 2019 | 2020 | |

| Inkomstpension | 1,367 | 1,398 | 1,490 | 1,646 |

| Premium pension | 1,030 | 1,161 | 1,280 | 1,518 |

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |||

|---|---|---|---|---|---|---|---|---|

| Inkomstpension | Reported capital management costs |

Operating expenses of the National Pension Funds (reported gross) |

0.08 | 0.07 | 0.07 | 0.07 | 0.07 | 0.06 |

| Fixed management fees (reported net) | 0.08 | 0.07 | 0.06 | 0.05 | 0.05 | 0.04 | ||

|

Total Reported capital management costs |

0.15 | 0.14 | 0.13 | 0.12 | 0.12 | 0.10 | ||

| Performance-based fees | 0.03 | 0.03 | 0.03 | 0.02 | 0.03 | 0.04 | ||

| Transaction costs | 0.03 | 0.02 | 0.02 | 0.02 | 0.01 | 0.02 | ||

| Total Inkomstpension | 0.21 | 0.19 | 0.18 | 0.16 | 0.16 | 0.15 | ||

| Premium pension | Reported capital management costs | Fixed management fees (reported net) | 0.25 | 0.23 | 0.22 | 0.20 | 0.18 | 0.17 |

|

Total Reported capital management costs |

0.25 | 0.23 | 0.22 | 0.20 | 0.18 | 0.17 | ||

| Transaction costs | 0.05 | 0.05 | 0.05 | 0.05 | 0.05 | 0.06 | ||

| Total Premium pension | 0.30 | 0.28 | 0.27 | 0.25 | 0.23 | 0.23 | ||

To cover the AP funds’ reported expenses for inkomstpension, a cost deduction is made from the pension balances each year. For the year 2020, cost deduction for inkomstpension from pension balances was 0.0305 percent. The deduction for costs is only made during the accumulation phase and not when the pension is disbursed. Neither the fixed net reported management fees of 0.04 percent of assets managed nor the performance-based fees nor the trading costs of 0.02 percent of assets managed are charged to pension savers through cost deductions.

The net reported costs are charged to the buffer capital in the AP funds, but unlike the gross reported costs are not financed through a deduction from pension savers’ inkomstpension accounts.

In 2020 the deduction for administrative costs for premium pension insurance was on average 0.04 percent of the premium pension capital. The maximum cost charged in 2020 was SEK 100 per account holder. The premium pension has, just like inkomstpension, small periodic discrepancies between fee charged and the actual cost. These deviations too are corrected continuously.

| 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|

| Inkomstpensiona | 0.0326 | 0.0284 | 0.0302 | 0.0305 | 0.0310 | 0.0288 | 0.0305 |

| Premium pension | 0.09 | 0.07 | 0.07 | 0.06 | 0.07 | 0.04 | 0.04 |

- The cost deduction for inkomstpension also includes costs incurred by the National Pension Funds . The deduction is made up until the point where the first payment is made.

| Tot.costs | Costs of administration including capital management costs |

| Adm.costs | Costs of administration |

| Capital | Premium pension capital |

Costs are an important factor in determining the size of a future pension. A seemingly low annual fee can reduce the pension by a considerable amount since the fee is deducted annually over a long period. Of the factors affecting pension capital, the size of costs is the one which the responsible authorities have the greatest opportunity to influence. Also the insured are able to influence certain costs for the premium pension.

The following simplified calculation provides a fairly accurate portrayal of how a certain cost percentage affects the size of the pension disbursed. The average time for which a paid-in contribution remains in the inkomstpension system before being disbursed is roughly 21 years.

If the cost of the inkomstpension is 0.03 percent, the charge for administrative costs will reduce the inkomstpension to (1–0.0003)21 which is about 99 percent of what it would have been without the charge, or by roughly 1 percent. If premium pension costs are 0.23 percent, the deduction will reduce the premium pension by just over 7 percent (1–0.0023)33 of what it would have been without the cost deduction. The reason for the deduction being made over 33 years is that in the premium pension system, pension capital is annually recalculated with costs deduction even during the period of retirement. The expected return is slightly higher, which contributes to a longer turnover period. A fairly normal management fee in Sweden for saving outside the national pension system is around 1 percent – not infrequently, it is even higher. If the charge for costs for the same period as in the example above is 1 percent, pension capital savings will be 72 percent of what they would have been with a fee of 0 percent; in other words, 28 percent is lost in charges for costs.

- The pension system’s income statements for inkomstpension and premium pension show the costs that the Swedish Pensions Agency and the National Pension Funds report as expenses in their own income statements as “gross reported costs.” ↩

- The asset management costs of the National Pension Funds and the premium pension system which are ‘net reported’ against revenue and net fund return are not visible in the income statement of the pension system. The concept of net reported costs refers here to such costs as those which in the National Pension Funds’ income statement consist of fixed management fees and which in the premium pension income statement are used as the net for items named management fees and discounts on management fees. ↩

- These costs are preliminary and are based on an upward adjustment of costs for the quarters 1–3. The amount does not include management fees relating to traditional insurance of SEK 11.5 million. This cost is net reported through a reduction in return on funded capital (see note 17 in Chapter 8) ↩