The principles of the inkomstpension and the premium pension are simple. A portion of your earnings each year is set aside in two different accounts. The pension is calculated on the basis of the amount of money you have in your account when you claim your pension, and how many more years you are expected to live from that point onwards. The purpose of this section is to provide those who so desire with somewhat more advanced knowledge than these elementary basic premises.

The national pension system works much like ordinary saving at the bank. The comparison applies to both earnings-related parts of the system, the inkomstpension and the premium pension. Each year pension contributions are paid by the insured, their employers and in certain cases the central government. Contributions are paid into two separate accounts, one for inkomstpension and one for premium pension. Savings grow through the years in line with the contributions paid and the ‘interest rate’ applicable to each account. The statement sent out each year in the Orange Envelope enables the insured to watch their own inkomstpension and premium pension accounts develop from year to year. When the insured individual retires, the stream of payments is reversed, and the inkomstpension and premium pension are disbursed for the remaining lifetime of the insured.

With pension insurance savings are blocked; it is impossible to withdraw all or any part of them before the minimum age for receiving a pension. Inkomstpension and premium pension can be claimed first at age 62.

One purpose of pension insurance is to redistribute assets from individuals with shorter-than-average life spans to those who live longer. The pension balances of deceased persons – so-called inheritance gains (see Appendix A) – are redistributed each year to the surviving insured in the same birth cohort. Also after pension withdrawal begins, assets are redistributed from those with shorter-than-average life spans to those who live longer. This is done by basing the monthly pension on average life expectancy but disbursing it for as long as the insured lives. Consequently, total pension disbursements to persons who live for a relatively short time after retirement are less than their pension savings, and those who live longer than average receive more than the value of their own pension savings.

The balance of an insured’s pension account consists of the sum of her/his pension credit (contributions), accrued interest and inheritance gains. A charge for administrative costs is deducted from the account each year.

The pension contribution is 18.5 percent of the pension base. The pension base consists of pension-qualifying income and pension-qualifying amounts. In addition to earnings, benefits from the social insurance and unemployment insurance systems are treated as income. Pension-qualifying amounts are a basis for calculating pension credit but are not income, properly speaking. Pension credit is granted for pension-qualifying amounts for sickness and activity compensation (disability pension), years with small children (child-care years), and studies. Up until 2010, pension-qualifying amounts were also granted for compulsory national service. As of 2018 it can be received again when compulsory military service is reintroduced. The maximum pension base is 7.5 income-related base amounts (SEK 501 000 in 2020). Pension credit is earned at 16 percent of the pension base for the inkomstpension and 2.5 percent for the premium pension.1

The insured pays an individual pension contribution to the national public pension of 7 percent of her/his earnings and any benefits received from the social insurance and/or unemployment insurance schemes. The contribution is paid on incomes up to 8.07 income-related base amounts2 and is paid in together with the withholding tax on earnings. The individual pension contribution of 7 percent is not included in the pension base. Annual earnings are pension-qualifying when they exceed the minimum income for the obligation to file a tax return, which as from 2003 is 42.3 percent of the current price-related base amount.3 When an individual’s income has exceeded this threshold, it is pension-qualifying from the first krona. Since the individual receives a tax deduction for national public pension contributions on their tax returns, it can be seen as the state paying the national public pension contribution.

For each employee, employers pay a pension contribution of 10.21 percent of that individual’s earnings.4 This contribution is also paid on earnings exceeding 8.07 income-related base amounts. Since there is no pension credit for earnings above 8.07 income-related base amounts, these contributions are in fact a tax. They are therefore allocated to the central-government budget as tax revenue rather than to the pension system.5

For recipients of pension-qualifying social insurance or unemployment insurance benefits, the central government pays a contribution of 10.21 percent of these benefits to the pension system. For persons credited with pension-qualifying amounts, the central government pays a contribution of 18.5 percent of the pension-qualifying amount to the pension system. These central government contributions to the old-age pension system are financed by general tax revenue.

The total pension contribution is thus 17.21 percent, whereas the pension credit and the pension contribution are 18.5 percent of the pension base. The reason for the difference is that the contribution base is reduced by the individual pension contribution of 7 percent when pension credit is calculated.6 This means that the maximum pension base is 93 percent of 8.07, or 7.5 income-related base amounts. The maximum pension credit in 2020 was SEK 92,685.

Of the pension contribution of 18.5 percent, 16 percentage points are deposited in the four buffer funds of the inkomstpension system: the First, Second, Third and Fourth National Pension Funds.7 Each fund receives one fourth of contributions and finances one fourth of pension disbursements. The monthly pension disbursements of the inkomstpension system thus come from the buffer funds. In principle, the same moneys that were paid in during the month are paid out in pensions to retirees.

The moneys allocated to the premium pension, 2.5 percent of the pension base, are invested in interest-bearing assets until the final tax settlement. Only then can it be determined how much pension credit for the premium pension has been earned by each insured. When pension credit has been confirmed, shares are purchased in the funds chosen by the insured. For those who have not chosen a fund, their moneys will be invested in the Seventh National Pension Fund, AP7 Såfa, the government pension management alternative based on birth cohorts, which has a generation-fund profile, including AP7. At the turn of the year 2020/2021, there were 486 funds in the premium pension system, administered by 65 different fund management companies. With each disbursement of pensions, enough fund shares are sold to provide the monthly amount.

| Number of registered funds 2020 | Managed capital | |||||

|---|---|---|---|---|---|---|

| 2016 | 2017 | 2018 | 2019 | 2020 | ||

| Equity funds | 346 | 388 | 441 | 407 | 517 | 582 |

| Mixed funds | 37 | 69 | 70 | 66 | 69 | 65 |

| Generation funds | 28 | 147 | 166 | 167 | 209 | 221 |

| Interest funds | 74 | 127 | 26 | 30 | 31 | 31 |

| AP7 Såfa/Premium Savings Fund | 1 | 328 | 407 | 433 | 632 | 680 |

| Total | 486 | 959 | 1,110 | 1,103 | 1,458 | 1,579 |

Savings in a bank account earn interest, and the national public pension works in the same way. The interest on the inkomstpension account is normally determined by the growth in average income. Average income is measured by the income index (see Appendix A). The equivalent of interest on the premium pension account is determined by the change in the value of the premium pension funds chosen by the insured.

Thus, the interest earned on pension credit depends on the development of different variables in the general economy. The inkomstpension account earns interest at the rate of increase in incomes. The development of the premium pension account follows the tendency on financial markets, which among other things reflects the price of capital. Neither of these rates of interest is guaranteed; they may even be negative. Through apportionment of contributions to separate subsystems where the rate of return depends on somewhat differing circumstances, risks are spread to some extent. The average return of the inkomstpension system (income-/balance index) has been 3.1 percent since 1995.8 During the same period, the Premium Pension system has generated an annual rate of return of 7.7 percent.

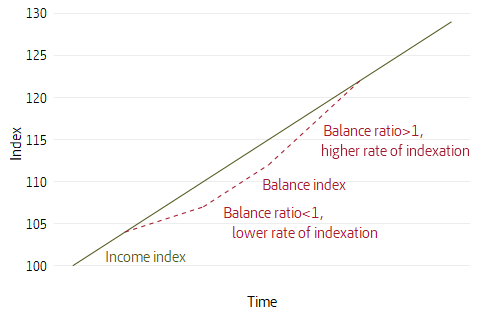

Under certain demographic and economic conditions, it is not possible to earn interest on the inkomstpension account and the inkomstpension at a rate equal to the growth in average income and at the same time to finance payments of the inkomstpension with a fixed contribution. In order to maintain the contribution rate at 16 percent, income indexation must be suspended in such a situation. This is done by activation of balancing.

The assets of the system divided by the pension liability provides a measure of its financial position, a ratio referred to as the balance ratio (balanstalet, BT). If the balance ratio is greater than the number one, assets exceed liabilities. If the balance ratio is less than one, liabilities exceed assets, and balancing is activated. When balancing is activated, pension balances and pensions are indexed by the change in a balance index instead of the change in the income index. The change in the balance index is determined by the change in the income index and the size of the balance ratio.

An example : If the balance ratio falls below 1.0000 to 0.9900 while the income index increases from 100.00 to 104.00 the damped balance ratio is first calculated according to: \(\frac{0.9900-1}{3} + 1 = 0.9967\).9

By multiplying the income index (104.00) by the damped balance ratio (0.9967) the balance index 103.66 is obtained.10 The indexation of pension balances is thus 3.66 instead of 4 percent. Indexation of pensions is reduced to the same extent.

If the balance ratio exceeds 1.0000 during a period when balancing is activated, pension balances and pensions will be indexed at a rate higher than the increase in the income index. When the balance index reaches the income index level, balancing is turned off. Pensions then regain the value they would have had if they had been indexed using the income index alone. The system returns to indexing based solely on changes in the income index. A schematic description is given in Figure 4.1.

The costs of administering the inkomstpension are deducted annually from pension balances through multiplication of these balances by an administrative cost factor (see Appendix A). This deduction is made only until the insured begins to draw a pension. At current cost levels, the deduction for costs will reduce the inkomstpension by approximately 1 percent compared to what it would have been without the deduction.

Similarly, the costs of administration and fund management in the premium pension system are deducted from premium pension capital. In this case, however, the deduction continues to be made after the insured begins to draw a pension. On average, the cost was 0.21 percent of premium pension capital in 2020. At this level of costs, the deduction for administrative costs will reduce the premium pension by an average of about 8 percent from what it would have been without any cost deduction. In order to reduce the costs of pension savers, capital managers associated with the premium pension system are required to grant a rebate on the ordinary expenses of the funds. The rebates to pension savers in 2020 are equivalent to a reduction in fund management fees of about 0.35 percentage points. Without the rebate, the premium pension would be about 12 percent lower.

The inkomstpension is calculated by dividing the balance of the inkomstpension account by an annuity divisor (see Appendix A) at the time of retirement. The annuity divisors are specific to each cohort and reflect partly the remaining life expectancy at the age pension is drawn and partly an advance interest of 1.6 percent. Remaining life expectancy is an average for men and women. The advance interest of 1.6 percent makes the annuity divisor lower than average life expectancy and thus initial pension is higher than it would have been without the interest.

An example: a person who retires at age 65 has a remaining life expectancy of about 20 years. The advance interest of 1.6 percent causes the annuity divisor to drop to 17.07. If the person has SEK 3 million in their inkomstpension account, the person receives SEK 175,700 per year (3 million/17.07) in inkomstpension or SEK 14,646 per month.

The inkomstpension is recalculated annually according to the change in the income index after deducting the advance interest of 1.6 percentage points credited in the annuity divisor, so-called adjustment indexation.11 This means that if the income index increases by exactly 1.6 percent more than inflation, as measured by the Consumer Price Index, pensions will increase at exactly the same rate as inflation. If the income index increases by more than 1.6 percent above the inflation rate, pensions will rise in constant prices, and vice versa. When balancing is activated, the income index is replaced by the balance index when pensions are recalculated.

The premium pension can be drawn either as traditional insurance with profit annuity or fund insurance. In both forms of insurance, the value of the pension account is divided by an annuity divisor, in the same way as with the inkomstpension. But for the premium pension, unlike the inkomstpension, the annuity divisor is based on forecasts of future life expectancy. The advance interest rate is currently 1.75 percent for both fund and traditional insurance, and a deduction for future costs of 0.1 percent is included in the calculation of the annuity divisors.

Fund insurance means that the pension savings remain in the premium pension funds chosen by the insured. With fund insurance, the amount of the premium pension is recalculated once each year based on the value of fund shares in December. Each month, a sufficient number of fund shares are sold to finance payment of the calculated premium pension. If the value of the fund shares increases, fewer shares are sold; if it decreases, more shares are sold. Variations in prices of fund shares affect the value of the following year’s premium pension.

Drawing premium pension in the form of traditional insurance means that the pension is calculated as a lifetime guaranteed nominal monthly amount and an additional amount varying in size from year to year. In the event of a transition to traditional insurance, the insured’s fund shares are sold and the Swedish Pensions Agency assumes responsibility for the management of the assets.

The premium pension may include a survivor benefit for the period of disbursement. This means that the premium pension will be paid to either of two spouses or cohabitants as long as one of them survives. If survivor benefit is chosen, the monthly pension will be lower because premium pension payment is expected to last longer.

Since 2018, fund managers are required by law to report on their sustainability efforts by indicating, inter alia, the methods they use and how they follow up their sustainability efforts. The Pensions Agency requires at the minimum that fund managers be signatories to the UnitedNations Principles for Responsible Investments (UN PRI). The Agency offers pension savers a range of tools to make it easy for them to choose sustainable funds on the premium pension market.

In 2020, the Pensions Agency examined in its sustainability report the extent to which pension savers actively make sustainable fund choices. Also in 2020, the premium pension fund market was prepared for imminent implementation of the EU Sustainable Finance Disclosure Regulation (Regulation (EU) 2020/852) which regulates, inter alia, how fund management companies, insurance companies, and financial advisors should inform investors and clients about environmental, social, and governance (ESG) aspects. The regulation was implemented on 10 March 2020, and its aim is to move towards more coherently designed sustainability-related information in the securities market.

Guaranteed Pension12

The guaranteed pension provides basic social security for individuals with little or no income. Residents of Sweden are eligible for a guaranteed pension beginning at age 65. To receive a full guaranteed pension, an individual must in principle have resided in Sweden for 40 years after age 25. Residence in another EU/EEA country can also be credited toward a guaranteed pension. Refugees can include residence in their home country and thus receive a full guaranteed pension.

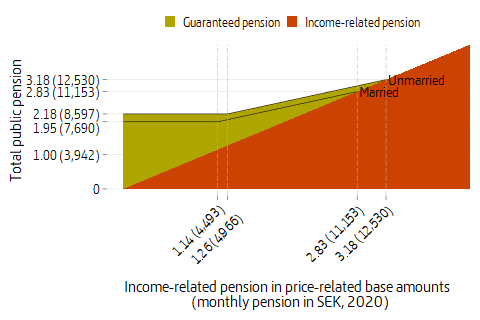

In 2020 the maximum guaranteed pension for a single pensioner was SEK 8,597 per month (2.181 price-related base amounts13) and for a married pensioner SEK 7,690 per month (1.951 price-related base amounts). The guaranteed pension is reduced for persons with an earnings-related pension. The reduction is taken in two steps: for low incomes, the guaranteed pension is decreased by the full amount of the earnings-related pension; for higher incomes, the guaranteed pension is decreased by only 48 percent. This means that a single pensioner with a monthly earnings-related pension of SEK 12,530 or more received no guaranteed pension in 2020. For a married pensioner the corresponding income limit was SEK 11,153.

An example: A pensioner living alone has an earnings-related pension equivalent to 2.26 price-related base amounts. The guaranteed pension is first reduced by the full amount of income up to 1.26 price-related base amounts. The remainder of 0.921 price-related base amount (=2.181–1.26) is reduced by 48 percent of the income above 1.26 price-related base amounts, which in this example gives a guaranteed pension of 0.441 price-related base amount (=0.921–0.48 \(\cdot\) (2.26–1.26)). The total inkomstpension and guaranteed pension will then be 2.701 price-related base amounts (0.441+2.26).

When calculating the guaranteed pension, the premium pension and the the effects of a possible early withdrawal of the inkomstpension are both disregarded. Rather the “inkomstpension” is calculated, which reduces the guaranteed pension as if it had been earned at 18.5 percent instead of 16 percent and as if it had been levied at the earliest at age 65. These rules facilitate administration of the guaranteed pension and mean that there is no financial gain from taking inkomstpension early.

The guaranteed pension is financed by the tax revenue of the central-government budget and is therefore not included in the income statement and balance sheet of the pension system.

Persons born before 1938 have not earned either an inkomstpension or a premium pension. Instead, they receive the ATP (supplementary pension) according to the old pension system. The level of the ATP pension is based on an individual’s income for the 15 years of highest income, and 30 years with income are required for a full pension.

For persons born in 1938–1953, there are special transitional provisions. These individuals receive a portion of their earnings-related old-age pension as an ATP and the rest as an inkomstpension and a premium pension. The younger the individual, the smaller the proportion of ATP. Persons born in 1938 receive 80 percent of their ATP; those born in 1939 receive 75 percent of their ATP, etc. There is an additional guarantee that the pension received will not be less than the ATP earned by the individual through 1994 – the year of the decision in principle to adopt the pension reform. Those born in 1954 or later earn their entire pensions under the provisions for the inkomstpension and the premium pension.

| Birth cohort | 61 | 62 | 63 | 64 | 65 | 66 | 67 | 68 | 69 | 70 | 71- | Total | Avg age |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1938 | 3.6 | 2.3 | 2.3 | 2.1 | 77.3 | 4.1 | 3.2 | 0.8 | 0.3 | 0.3 | 0.7 | 97.1 | 64.9 |

| 1939 | 3.9 | 1.9 | 2.1 | 2.3 | 75.6 | 6.5 | 2.3 | 0.8 | 0.3 | 0.3 | 0.8 | 96.9 | 65.0 |

| 1940 | 3.0 | 2.1 | 2.5 | 3.1 | 75.9 | 5.0 | 2.6 | 0.8 | 0.4 | 0.5 | 0.7 | 96.6 | 65.0 |

| 1941 | 2.9 | 2.2 | 3.0 | 3.7 | 73.2 | 6.3 | 2.8 | 0.8 | 0.5 | 0.4 | 0.7 | 96.5 | 65.0 |

| 1942 | 3.4 | 2.9 | 3.4 | 3.9 | 70.8 | 6.2 | 3.4 | 1.2 | 0.5 | 0.4 | 0.7 | 96.7 | 64.9 |

| 1943 | 3.9 | 3.1 | 3.6 | 5.3 | 66.4 | 7.1 | 4.4 | 1.2 | 0.4 | 0.5 | 0.8 | 96.6 | 64.9 |

| 1944 | 4.7 | 3.4 | 4.7 | 5.9 | 63.1 | 7.9 | 4.0 | 1.1 | 0.5 | 0.5 | 0.8 | 96.5 | 64.9 |

| 1945 | 5.1 | 4.2 | 5.3 | 6.1 | 61.5 | 7.2 | 4.0 | 1.3 | 0.5 | 0.5 | 0.8 | 96.4 | 64.8 |

| 1946 | 6.0 | 4.8 | 5.4 | 6.7 | 59.1 | 6.7 | 4.2 | 1.2 | 0.5 | 0.6 | 0.8 | 96.1 | 64.7 |

| 1947 | 6.3 | 4.6 | 6.0 | 7.4 | 56.7 | 6.9 | 4.7 | 1.3 | 0.6 | 0.5 | 1.0 | 95.9 | 64.7 |

| 1948 | 6.0 | 4.9 | 6.7 | 7.8 | 54.6 | 7.3 | 5.0 | 1.5 | 0.5 | 0.5 | 1.0 | 95.8 | 64.7 |

| 1949 | 5.8 | 5.4 | 6.9 | 8.6 | 52.2 | 7.9 | 5.4 | 1.4 | 0.6 | 0.5 | 1.1 | 95.8 | 64.7 |

| 1950 | 5.8 | 5.4 | 7.7 | 9.1 | 49.9 | 8.6 | 5.4 | 1.6 | 0.7 | 0.6 | 1.1 | 95.9 | 64.7 |

| 1951 | 6.5 | 6.3 | 8.0 | 9.3 | 47.5 | 8.3 | 5.5 | 1.8 | 0.7 | 0.6 | 1.2 | 95.8 | 64.7 |

| 1952 | 6.8 | 6.8 | 8.4 | 10.3 | 44.3 | 8.9 | 6.0 | 2.0 | 0.8 | 0.6 | 1.2 | 96.1 | 64.7 |

| 1953 | 7.7 | 6.5 | 9.4 | 10.4 | 41.8 | 9.5 | 5.1 | 3.0 | 0.9 | 0.7 | 1.2 | 96.0 | 64.6 |

| 1954 | 7.5 | 7.1 | 9.5 | 10.7 | 40.3 | 9.7 | |||||||

| 1955 | 7.5 | 6.6 | 10.2 | 11.1 | 39.3 | ||||||||

| 1956 | 7.0 | 7.8 | 10.3 | 10.8 | |||||||||

| 1957 | 7.7 | 7.8 | 9.8 | ||||||||||

| 1958 | 8.9 | 7.5 |

- The proportions are for new retirees in relation to the potential number of retirees as of December 2019. Ages are as of December 31 of the year when the pensioner began drawing an inkomstpension/guaranteed pension. Prognosis for the highest ages, prognosis in italics. For those born 1959, the minimum withdrawal age is 62 and they are therefore not included.

| Number of women | Proportion, percent | Number of men | Proportion, percent | Number in total | Proportion, percent | |

|---|---|---|---|---|---|---|

| Newly granted | 54 | 4.3 | 54 | 4.8 | 108 | 4.6 |

| Deceased | 47 | 3.8 | 46 | 4.1 | 93 | 3.9 |

| Old-age pensioners | 1,244 | 1,119 | 2,363 |

- Applies to those who have an inkomstpension, supplementary pension, or guaranteed pension.

| Amount women | Proportion, percent | Amount men | Proportion, percent | Total amount | Proportion, percent | |

|---|---|---|---|---|---|---|

| Newly granted | 657 | 4.3 | 740 | 4.5 | 4.5 | |

| Deceased | 487 | 3.4 | 665 | 4.1 | 3.7 | |

| Old-age pensioners | 14,438 | 16,306 |

- The monthly amount is for the last month the individual had a pension.

Individuals new granted pension in 2020 accounted for 4.6 percent of all old-age pensioners and those who died accounted for 3.9 percent of the total.

Pensions paid to new beneficiaries were 4.5 percent of all payments and were slightly higher than the pensions of the deceased would be were they still alive, which was 3.7 percent.

This section describes the pension system in figures.

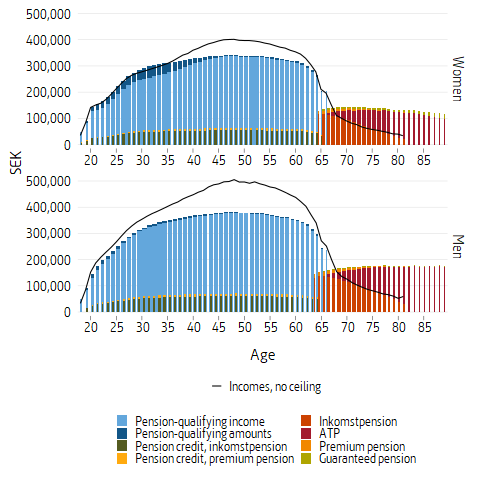

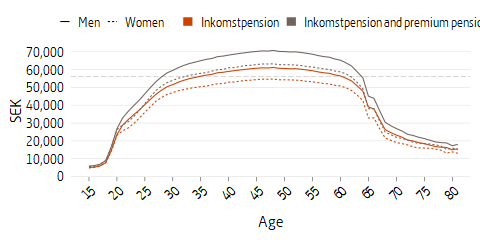

Figure 4.3 shows average income for 2019, average pension credits to savers’ accounts in 2020 and average pension disbursement in 2019.

The average income increases during the first half of the earnings period, then levels off at age 45 before turning downwards and falling sharply after age 60. One reason for the decrease in average income is the increase in the proportion of persons with sickness compensation (disability pensioners) with lower average incomes. Another reason for the decrease in average income is that certain individuals have reduced their work hours, or have fully retired during the year. The importance of the upper limit, the ceiling, on the earning of pension credit is shown in the figure – the average pension-qualifying income (pensionsgrundande inkomst, PGI) would follow the line for Incomes, no ceiling if there had not been a ceiling.

Persons with an income lower than 0.423 price base amount (SEK 19,670) for 2019) are included in the uncapped income (no ceiling income) group, but do not receive a fixed pension-qualifying income. In some age groups, where a relatively large proportion have an income below the limit, the average pension-qualifying income is greater than the average income. This has to do with low-income people pulling down the average income, but does affect the average pension-qualifying income. These age groups are found mainly among younger people, a majority of whom have only sporadic income, and among women aged 66–67, a relatively high proportion of whom have an income below the limit.

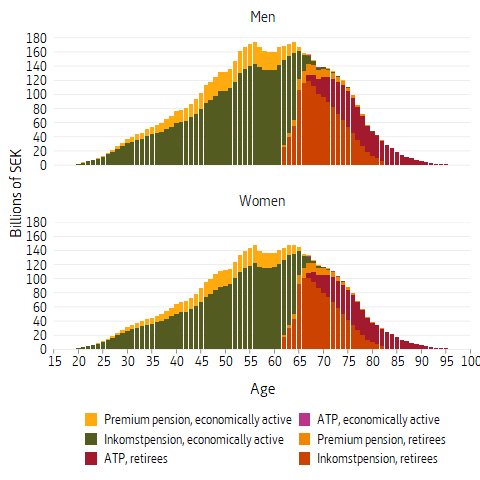

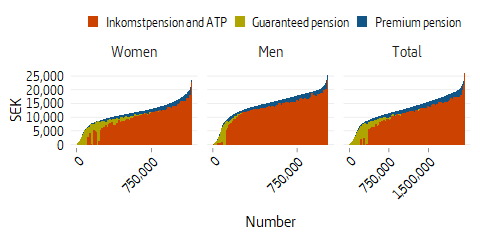

The figure provides an overview of the level of disbursements to the 2,269,000 people receiving a pension from the public pension system in December 2019. ATP pension still accounted for the largest part of the pension but it is noticeable that inkomstpension and premium pension begin to replace ATP pension for cohorts born in 1938 and later. For younger cohorts, their pension consists wholly or almost wholly of inkomstpension, premium pension and guarantee pension. Guarantee pension still makes up a large part of the pension, especially among older cohorts. For the older age groups, the guaranteed pension is a large part of the pension, especially for women. For the younger cohorts, the guaranteed pension represents an increasingly small part of their pension.

The width of the bars reflects the number of people in the annual cohort, with cohort 1990 as the norm.

Refers to 18–89 years.

Figure 4.3 show that women on average have lower incomes than men. We also see that the ceiling on pension-qualifying income has a greater negative influence for men than for women, since a larger share of men’s incomes are above the ceiling. The fact that women have a greater share of pension-qualifying amounts than men is illustrated by the fact that women have more dark blue in their pension base than men - more details on pension-qualifying amounts can be found in Figure 4.6. Moreover, women on average have lower pensions and considerably more guaranteed pension than men.

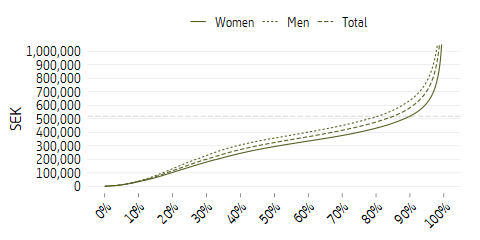

Figure 4.4 below shows uncapped pension-qualifying income divided between women and men. Incomes up to 8.07 income-related base amounts (SEK 519,700 for income year 2019) form the base for the national pension. The diagram below shows incomes for the income year 2019 divided up in rising order (in total 5,779,000 persons, of which 2,809,000 women and 2,970,000 men. Of these, 4,859,000 people had incomes below the contribution ceiling (2,507,000 women and 2,352,000 men).

Roughly 618,000 men, or 21 percent of men, had an income above the ceiling on pension-qualifying income. The corresponding proportion for women was 11 percent or approximately 302,000 persons. The table below shows the average uncapped pension-qualifying income and pension-qualifying income for women and men.

| Uncapped pension-qualifying income | Pension-qualifying income | |

|---|---|---|

| Women | 295,300 | 276,700 |

| Men | 368,100 | 319,300 |

| Total | 332,700 | 298,600 |

Table 4.5 reveals that women’s incomes are lower than men’s – 80 percent of uncapped pension-qualifying income and 87 percent of pension-qualifying income.

The average pension credit for inkomstpension and premium pension in 2019 amounted to SEK 56,000 – lower for women (SEK 53,000) and higher for men (SEK 58,900). See table 4.6 below.

| Inkomstpension | Premium pension | Total | |

|---|---|---|---|

| Women | 46,000 | 7,000 | 53,000 |

| Men | 51,000 | 7,900 | 58,900 |

| Total | 48,600 | 7,400 | 56,000 |

From the table above and figure 4.5 it can be seen that the average pension credit for women was approximately 90 percent of men’s.

The average pension credit to inkomstpension and premium pensions decreases sharply between ages 64 and 65 and then levels off between 65 and 66 (age at the end of the year). This has to do with many people choosing to take their pension and stop working at 65, resulting in lower annual income and less pension credit earned during that year.

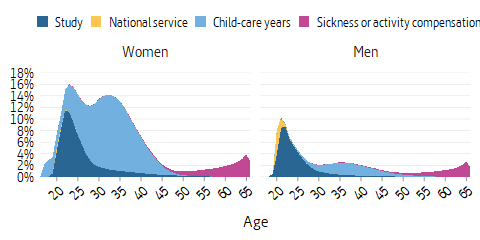

Credit is granted for pension-qualifying amounts in particular phases of individuals’ lives, such as years with small children or of studies. Between 1995 and 2010, national service gave pension credit. After being dormant since 2010, conscription was resumed in 2018, and since then conscription once more provides pension credit. Those who earned pension credit from national service in 2019 were primarily men.

In 2019 pension-qualifying amounts constituted 6 percent of the allocated pension base for women and approximately 2 percent for men. The largest portion for women, 4 percent, consisted of amounts for years with small children. For men childcare years also made up the largest portion, nearly 1 percent of the total pension base.

Viewed over a life cycle, pension-qualifying amounts are received by younger people for study, national service and years with children, and later in life amounts are received for sickness compensation.

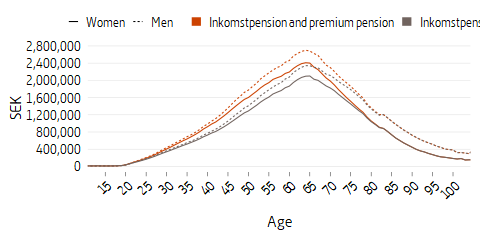

The pension liability – the pension capital of the insured – in the inkomstpension and the premium pension system was SEK 11,440 billion billion as of December 31, 2020. The liability, broken down by sex, for ages 15 and up, is shown in Figure 4.7.

Women have lower earned pension capital compared with men. It is also clear that supplementary pension (ATP) is the principal pension asset for older pensioners but will soon have completely disappeared for working-age cohorts.

For savers, inkomstpension dominates, while the increasing importance of premium pension can be seen. Provisions for premium pension were introduced in 1995, before which all pension credits were set aside for inkomstpension. Assuming that earnings began at age 20, everyone aged 45 or younger in 2020 has been earning income and premium pension throughout their working life.

| Inkomstpension | Premium pension | Total | |

|---|---|---|---|

| Women | 1,066,000 | 191,000 | 1,239,000 |

| Men | 1,204,000 | 223,000 | 1,408,000 |

| Total | 1,137,000 | 207,000 | 1,325,000 |

Average pension liability (the sum of all years of earned pension credit for inkomstpension and premium pension) amounted to just over SEK 1.3 million at the end of 2020. See table 4.7.

The figure above shows that average liability increases with increasing age up to and including the age of 65. After that, liability decreases, since many after that have entered retirement.

In Figure 4.9 below the disbursements of the national pension are shown in rising order of size. Disbursements refer to December 2020 for women and men born in 1955 or earlier (1,157,000 women and 1,028,000 men). For total pensions disbursed during 2020, see Note 2 in the chapter Notes and Comments.

The difference in level and composition of different parts of pensions for men and women is the most striking feature of the figure. The average pension for women – income-based pension and guaranteed pension – was SEK 11,700. The corresponding amount for men was SEK 14,700. Of women’s national pensions, 93 percent consisted of income-based pensions and 7 percent of guaranteed pensions. However, a full 47 percent of women had some portion of guaranteed pension. That the proportion with guaranteed pension increases sharply with age is not shown by the diagram. Of the national pension for men, 98 percent consisted of income-based pension and 2 percent of a guaranteed pension. A total of 16 percent of men had some proportion of guaranteed pension. Neither the widow’s pension nor the housing supplement, each of which is paid primarily to women, is included in the figure.

The completely green bars indicate persons who have only guaranteed pension and no income-based pension. This group consists predominantly of women. Persons without an income-based pension with at least 40 years of residence in Sweden receive the maximum guaranteed pension. This explains the concentration of green at the maximum guaranteed pension for “married persons” (SEK 7,690 per month in 2020) and for “unmarried persons” (SEK 8,597 per month).

Those with a lower guaranteed pension, but also without any income-based pension, have fewer years of residence in Sweden. Only persons born in 1938 or later can receive premium pension – based on their own income, but only on that part earned since 1995. Thus the impact of premium pension is still limited. However, the importance of premium pension is growing with each new annual cohort that draws a pension. The few individuals with a national pension exceeding SEK 20,000 per month have reached that pension amount in part by postponing pension withdrawal. The maximum public pension paid in 2020 was SEK 54,300 per month. It is a person born later than 1938 who has continued to work after the age of 65 and who has postponed withdrawing a pension.

The balance ratio is a crucial measure of the financial position of the inkomstpension. It is used as part of the system’s indexation mechanism to ensure its financial stability. This section explains how the balance ratio is affected by some key factors.

The balance ratio is calculated as the ratio between the assets and liabilities of the inkomstpension system. The assets consist of the assets of the AP funds (the buffer funds) and the contribution asset. The contribution asset consists of the year’s contribution revenue multiplied by turnover duration, where turnover duration measures how long it is expected to take, on average, from the payment of SEK 1 in contribution to the system (income age) until the pension credit created by the contribution is paid out in the form of pension (payment age)14.

The turnover duration – the difference between expected payment age and earning age – decreases if average pension credits increase less for younger than for older people (increased earning age). For example, this may happen if labour market entry is delayed. It also falls if pension withdrawals are brought forward (reduced payment age). Turnover duration tends to increase with increased life expectancy, especially if the life expectancy of those with above-average pension incomes increases (higher payment age).

The inkomstpension system has a liability to economically active persons and to pensioners. The liability to economically active persons increases with earned pension credits, while the liability to pensioners decreases with pension disbursements. Liabilities are recalculated using the income index (or balance index when balancing is activated). The liability also increases with increased life expectancy, especially if life expectancy of people with above-average pension amounts increases.

The fact that a general increase in life expectancy increases liability as well as assets reduces the balance ratio sensitivity to changes in life expectancy, even if the increase in assets is less than the increase in liability.

To this must be added the buffer funds. If the return on buffer fund capital is higher than growth in average income, the funds contribute to strengthening the balance ratio. Buffer funds account for approximately 16 percent of the assets of the inkomstpension system, but as the funds’ returns are much more volatile than other factors, the funds have a greater impact on the development of the balance ratio relative to their share of assets.

The number of persons with pension-qualifying income affects the relationship between contribution asset and pension liability

The contribution asset grows mainly with the change in the inflow of contrbutions (the sum of the pension base) and the liability is growing mainly by the change in the income index (average income). This means that if the sum of pension-qualifying income grows faster than average, the balance ratio increases (all else being equal). In principle, this is true if employment increases, but as the contribution base to the pension system includes the unemployment benefit, the sickness benefit, and the sickness compensation, the link to employment trends is not absolute. However, the link to the evolution of the number of persons with pension-qualifying income is central. If the number of people with pension-qualifying income increases, the balance ratio is affected in a positive direction.15

Above is described, in a somewhat stylised fashion, how changes in the balance ratio can be broken down into changes in the ratio between contribution revenue and average income, changes in turnover duration and changes in pensioner life expectancy, as well as the return on buffer fund capital. In particular, the relationship between contribution revenue and average income is affected by the utilisation of resources in the labour market, which varies with the business cycle.

The state of the economy is often described in terms of how actual GDP values, employment, and other indicators relate to corresponding potential values.16 The difference between the growth of actual and potential variables can therefore be used as an approximate measure of cyclical adjustment of the ratio of contribution revenue to average income. As described above, the relationship between contribution revenue and average income is mainly influenced by the rate of change in the number of people with pension-qualifying income. Below, the rate of change in the size of the labour force is used as an approximation of the rate of change in the number of persons with pension-qualifying income. Based on this, a cyclical effect on the ratio of contribution revenue to average income is estimated.

The economic downturn triggered by the Covid-19 pandemic meant that the number of employed persons decreased and the number of persons outside the labour force increased. The employment rate fell for the first time since the financial crisis.17 The actual labour force for 2020 was lower than the potential one, while that of 2019 was slightly higher18, which according to the above reasoning would constitute a negative contribution to the balance ratio.

Turnover duration can also be affected by the business cycle. Delayed labour market entry, which often occurs especially in deeper recessions, tends to increase the earning age and thereby reduce turnover duration. In contrast, fund returns over the past 30 years have not tended to be correlated with indicators of the economic situation.

To illustrate some possible scenarios, a number of stress tests are carried out on a simplified balance sheet and balance ratio. The examples are to be regarded as purely illustrative.

Option 1: No change in contribution revenues, but the number of persons with pension-qualifying income adjusted for the difference between the actual and the potential workforce. As a consequence, the income index is adjusted downwards by 0.2 percent for 2020 and adjusted upwards by 0.4 percent for 2021.

Option 2: Buffer fund returns are reduced by SEK 162 billion in 2020 (corresponding to the funds’ results at mid-year 2020).

Option 3: Lowest withdrawal age 63 in 202019

| 2020 | Change, alternative 1 | Change, alternative 2 | Change, alternative 3 | ||

|---|---|---|---|---|---|

| Change in fund assets | Pension contributions | 295,499 | 0 | 0 | 0 |

| Pension disbursements | -326,266 | 0 | 0 | 1,869 | |

| Return on funded capitala | 130,865 | 0 | -170,465 | 0 | |

| Total Change in fund assets | 100,098 | 0 | -170,465 | 1,869 | |

| Change in contribution assets |

Value of change in contribution income |

182,990 | 0 | 0 | 179 |

|

Value of change in turnover duration |

93,798 | 0 | 0 | 17,190 | |

|

Total Change in contribution assets |

276,788 | 0 | 0 | 17,369 | |

| Change in pension liability | New pension credit | -304,394 | 0 | 0 | 0 |

| Pension disbursements | 326,257 | 0 | 0 | -1,869 | |

| Indexation | -339,735 | -34,977 | 0 | 808 | |

| Other | -645 | 0 | 0 | 0 | |

| Value of change in life expectancy | -10,503 | 0 | 0 | 90 | |

| Total Change in pension liability | -329,020 | -34,977 | 0 | -971 | |

| Net income for the year | 47,866 | -34,977 | -170,465 | 18,267 | |

| Assets | Fund assets | 1,696,440 | 0 | -170,465 | 1,869 |

| Contribution assets | 8,893,004 | 0 | 0 | 17,369 | |

| Total assets | 10,589,444 | 0 | -170,465 | 19,238 | |

| Liabilities and income | Closing balance | 806,196 | -34,977 | -170,465 | 18,267 |

| Pension liability | 9,783,248 | 34,977 | 0 | 971 | |

| Total liabilities and income | 10,589,444 | 0 | -170,465 | 19,238 | |

| Balance ratio | 1.0824 | -0.0031 | -0.0174 | 0.0019 | |

- Including administration costs (which are assumed to be the same in alternative with reduced returns).

In the first option, the income index for 2021 is assumed to be higher than it actually was (due to fewer people with PGI) and slightly lower for 2020 (due to more people with PGI), which increases pension liability slightly and the balance ratio thus weakens marginally. The second option, which corresponds to the position of the buffer funds after the first half of 2020, and in which fund returns are reduced by approx. SEK 162 billion, has a significantly greater impact on the balance ratio.

It may also be noted that raising the minimum age for pension disbursement strengthens the balance ratio even under the assumption that contribution income does not increase, mainly because the payment age increases. If raising the minimum age also leads to increased labour force participation, the balance ratio is further strengthened.

- Pension credit for the premium pension may be transferred between spouses. Transferred capital is currently reduced by 6 percent, since more transfers are made to women than to men and women on average live longer than men. ↩

- In 2020: 8.07 x the income-related base amount = SEK 539,076. ↩

- In 2020: 0.423 x 47,300 = SEK 20,008. ↩

- Self-employed persons pay a national pension contribution of 7 percent and self-employment charge of 10.21 percent. ↩

- This tax was SEK 20.6 billion in 2020; see Chapter 8 Note 1. ↩

- 0.1721 / 0.93 \(\approx\) 0.185 ↩

- In addition there is the Sixth National Pension Fund, which is an asset in the inkomstpension system but provides no contributions and pays no pensions. ↩

- Capital-weighted return. For further information, see chapter 6 Changes in the Value of the Pension System, section on measures of change in value in the premium pension system. ↩

- The balance index for the year 2017 and later will be calculated using the damped balance ratio (SFS:676). See also Appendix B. ↩

- Next year’s balance index is calculated by multiplying the balance index (103.66) by the change in the income index, multiplied by the damped balance ratio. See Appendix A. ↩

- The inkomstpension is recalculated as the ratio between the new and the old income index divided by 1.016. In years for which a balance ratio has been set, the income index is replaced by the balance index. ↩

- These provisions concern the guaranteed pension for persons born in 1938 or later. For older individuals, other rules apply. ↩

- In 2020 the price-related base amount was SEK 47,300. ↩

- Details can be found in Appendix B, Mathematical description of the balance ratio. ↩

- Since the income measure in the income index is based on the sum of pension-qualifying income without limitation of the ceiling on pension-qualifying earnings (uncapped PGI), differences in income growth above and below the earnings ceiling can in principle affect the balance ratio. However, in recent years, differences in the rate of change between contribution revenue and uncapped PGI have been small. ↩

- The levels that are consistent with stable inflation in the long run. See the The Swedish National Institute of Economic Research (2018) The Economic Situation in October 2018, pp. 75-79, for a further description of economic terminology. ↩

- SCB (2021) The labour market situation for the entire population age 15–74, AKU 2020 (in Swedish). ↩

- Swedish Pension Agency’s calculations based on data from the National Institute of Economic Research’s forecast from December 2020. ↩

- In this case it is assumed that earning is constant, that changes in the payment age will take full effect starting in 2020 and that no pensioners are born in 1958. ↩